Buy Sell Indicator Software

Buy Sell Indicator Software' title='Buy Sell Indicator Software' />Automatic Buy Sell Signals Software with Targets, Stoploss, Support Resistance Levels Technical Analysis Software Charting Software for MCX, NCDEX, SHARES. Mudraa Soft Trade provides Best Buy Sell Signal Software for NSE, MCX, Nifty, Banknifty. Its 100 profit making software for indian stock market. It generates.

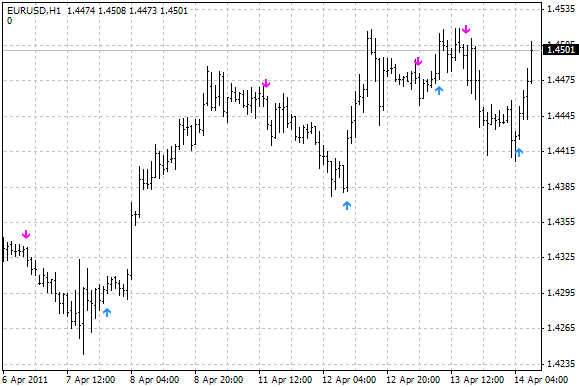

Krugerrands. Plus free Storage Insurance and Assured Buyback for all our clients. Click for rates. First of all, Who is it For Black Diamond Trader 2 can be used by ANYONE who trades ANY market Whether you wish to be a successful Scalper, Day Trader, Swing Trader. Find out how stochastics are used to create buy and sell signals for traders. At this page you can download MT4 Forex indicator that can be attached to the MetaTrader Forex trading platform to boost your Forex trading performance. An Accurate Buy And Sell Indicator. George Lane developed stochastics, an indicator that measures the relationship between an issues closing price and its price range over a predetermined period of time. C Windows Form Mouse Events Unity. Fourteen is the mathematical number used in the time model, and it can, depending on the technicians goal, represent days, weeks or months. The chartist may want to examine an entire sector. For a long term view of a sector, the chartist would start by looking at 1. For more insight on chart reading, see Charting Your Way To Better Returns. Price Action. The premise of stochastics holds that a stocks closing price tends to trade at the high end of the days price action. Price action is the prices at which a stock traded throughout the daily session. The stock may have opened at 1. The price action of this example is between 9. If the issue, however, is currently in a downtrend cycle, the closing prices will tend to close at or near the low of the trading session. Learn German Audio Cd. Jack D. Schwager, the CEO of Wizard Trading and author of some the best books written on technical analysis, uses the term normalized to describe stochastic oscillators that have predetermined boundaries both on the high and low sides. An example of such an oscillator is the relative strength index RSI which has a range of 0 1. Whether your looking at a sector or an individual issue, it can be very beneficial to use stochastics and the RSI in conjunction with each other. For more, see Ride The RSI Rollercoaster and Exploring Oscillators and Indicators RSI. Formula. Stochastics is measured with the K line and the D line, and it is the D line that we follow closely, for it will indicate any major signals in the chart. Mathematically, the K line looks like this K 1. C L5closeH5 L5C the most recent closing price. L5 the low of the five previous trading sessions. H5 the highest price traded during the same 5 day period. The formula for the more important D line looks like this We show you these formulas for interests sake only. Todays charting software does all the calculations, making the whole technical analysis process so much easier and thus more exciting for the average investor. For the purpose of realizing when a stock has moved into an overbought or oversold position, stochastics is the favored technical indicator as it is easy to perceive and has a high degree of accuracy. Reading the Chart. The K line is the fastest and the D line is the slower of the two lines. The investor needs to watch as the D line and the price of the issue begin to change and move into either the overbought over the 8. The investor needs to consider selling the stock when the indicator moves above the 8. Conversely, the investor needs to consider buying an issue that is below the 2. Over the years many have written articles exploring the tweaking of this indicator, but new investors should concentrate on the basics of stochastics. In the above chart of e. Bay, a number of clear buying opportunities presented themselves over the spring and summer months of 2. There are also a number of sell indicators that would have drawn the attention of short term traders. The strong buy signal in early April would have given both investors and traders a great 1. The current run in the stock started with a strong buy signal just two weeks ago. Although the buy signal appears to have been a false start, it has confirmed that, even in these tough market conditions for the Internet stocks, more new money is coming into e. Bay. Conclusion Stochastics is a favorite indicator of some technicians because of the accuracy of its findings. It is easily perceived both by seasoned veterans and new technicians, and it tends to help all investors make good entry and exit decisions on their holdings. For more insight, read Exploring Oscillators and Indicators Stochastic Oscillator.

Krugerrands. Plus free Storage Insurance and Assured Buyback for all our clients. Click for rates. First of all, Who is it For Black Diamond Trader 2 can be used by ANYONE who trades ANY market Whether you wish to be a successful Scalper, Day Trader, Swing Trader. Find out how stochastics are used to create buy and sell signals for traders. At this page you can download MT4 Forex indicator that can be attached to the MetaTrader Forex trading platform to boost your Forex trading performance. An Accurate Buy And Sell Indicator. George Lane developed stochastics, an indicator that measures the relationship between an issues closing price and its price range over a predetermined period of time. C Windows Form Mouse Events Unity. Fourteen is the mathematical number used in the time model, and it can, depending on the technicians goal, represent days, weeks or months. The chartist may want to examine an entire sector. For a long term view of a sector, the chartist would start by looking at 1. For more insight on chart reading, see Charting Your Way To Better Returns. Price Action. The premise of stochastics holds that a stocks closing price tends to trade at the high end of the days price action. Price action is the prices at which a stock traded throughout the daily session. The stock may have opened at 1. The price action of this example is between 9. If the issue, however, is currently in a downtrend cycle, the closing prices will tend to close at or near the low of the trading session. Learn German Audio Cd. Jack D. Schwager, the CEO of Wizard Trading and author of some the best books written on technical analysis, uses the term normalized to describe stochastic oscillators that have predetermined boundaries both on the high and low sides. An example of such an oscillator is the relative strength index RSI which has a range of 0 1. Whether your looking at a sector or an individual issue, it can be very beneficial to use stochastics and the RSI in conjunction with each other. For more, see Ride The RSI Rollercoaster and Exploring Oscillators and Indicators RSI. Formula. Stochastics is measured with the K line and the D line, and it is the D line that we follow closely, for it will indicate any major signals in the chart. Mathematically, the K line looks like this K 1. C L5closeH5 L5C the most recent closing price. L5 the low of the five previous trading sessions. H5 the highest price traded during the same 5 day period. The formula for the more important D line looks like this We show you these formulas for interests sake only. Todays charting software does all the calculations, making the whole technical analysis process so much easier and thus more exciting for the average investor. For the purpose of realizing when a stock has moved into an overbought or oversold position, stochastics is the favored technical indicator as it is easy to perceive and has a high degree of accuracy. Reading the Chart. The K line is the fastest and the D line is the slower of the two lines. The investor needs to watch as the D line and the price of the issue begin to change and move into either the overbought over the 8. The investor needs to consider selling the stock when the indicator moves above the 8. Conversely, the investor needs to consider buying an issue that is below the 2. Over the years many have written articles exploring the tweaking of this indicator, but new investors should concentrate on the basics of stochastics. In the above chart of e. Bay, a number of clear buying opportunities presented themselves over the spring and summer months of 2. There are also a number of sell indicators that would have drawn the attention of short term traders. The strong buy signal in early April would have given both investors and traders a great 1. The current run in the stock started with a strong buy signal just two weeks ago. Although the buy signal appears to have been a false start, it has confirmed that, even in these tough market conditions for the Internet stocks, more new money is coming into e. Bay. Conclusion Stochastics is a favorite indicator of some technicians because of the accuracy of its findings. It is easily perceived both by seasoned veterans and new technicians, and it tends to help all investors make good entry and exit decisions on their holdings. For more insight, read Exploring Oscillators and Indicators Stochastic Oscillator.